Introduction

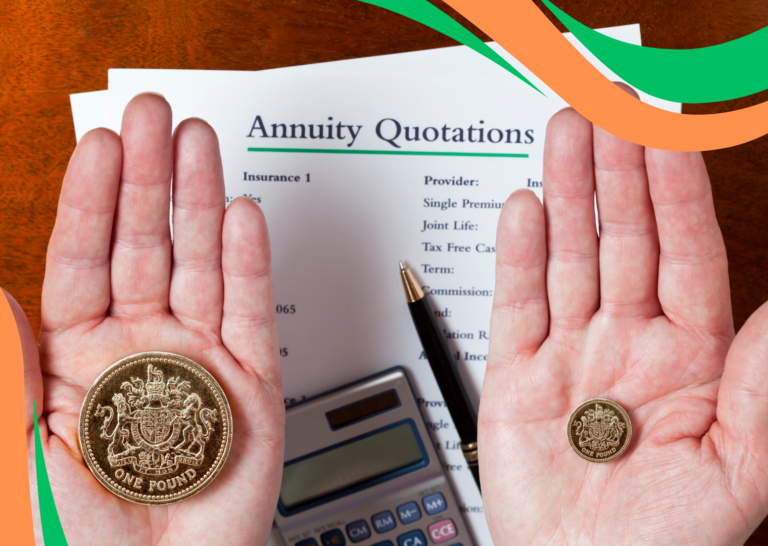

Can annuities help protect against outliving my savings?

Running out of money in retirement is a common concern, but annuities can be a powerful tool for providing long-lasting financial security. Here’s a clear breakdown of how annuities work to ensure income for life, helping you avoid the risk of outliving your savings.

1. Understanding the Lifetime Income Feature

One of the most attractive features of annuities is their ability to provide guaranteed income for life. When you purchase an annuity, you make an agreement with an insurance company to receive regular payments, which can be set to last a specific number of years or your entire lifetime. This unique feature allows annuities to offer a consistent income regardless of how long you live.

- Lifetime Income Options: Most annuities, particularly lifetime annuities, allow you to choose income that lasts for your lifetime (or even include your spouse, with “joint life” options).

- Protection Against Longevity Risk: Since life expectancy is increasing, more people are living into their 80s, 90s, and beyond. An annuity helps protect against the risk of outliving your savings by guaranteeing you’ll receive income for as long as you live.

2. Types of Annuities Ideal for Lifetime Income

Various annuities offer different approaches to securing lifetime income, each with unique benefits. Here’s how some of the main types can help protect your retirement funds:

- Immediate Annuities: If you need income soon after retiring, an immediate annuity provides payments right after a lump-sum purchase. This option is useful for those who want an immediate income stream.

- Deferred Annuities: For people who are a few years away from retirement, a deferred annuity allows you to accumulate tax-deferred growth, and then start receiving payments later. This type can help you prepare in advance and maximize income when it’s most needed.

- Fixed Annuities: Fixed annuities offer a guaranteed interest rate and stable payments, which make them appealing to conservative retirees who want predictable, steady income.

- Variable and Indexed Annuities: These options offer the potential for higher growth based on market performance but can still include guaranteed income riders to ensure a minimum level of income. This combination allows you to benefit from growth without risking your income.

3. Income Riders: Guaranteeing Payments Regardless of Market Conditions

Many variable and indexed annuities come with optional income riders, like the Guaranteed Lifetime Withdrawal Benefit (GLWB). These riders, while often costing an additional fee, guarantee a minimum payment amount each year, even if the investment itself underperforms.

- Guaranteed Lifetime Withdrawal Benefit (GLWB): This rider allows you to withdraw a certain percentage of your initial investment each year for life, providing consistent income even if your account balance goes to zero due to poor market performance.

- Added Peace of Mind: With income riders, you’re protected from market volatility affecting your monthly income, making them ideal for those who want some market exposure without risking their retirement income.

4. How Annuities Work in Conjunction with Other Retirement Income

Annuities work well alongside other retirement income sources like Social Security, pensions, and 401(k) withdrawals. Many retirees use an annuity to cover essential expenses like housing, groceries, and healthcare, allowing them to invest other assets for growth or unexpected expenses. Here’s how this strategy works:

- Layered Income Approach: You can use annuities to cover fixed expenses, ensuring your basic needs are met for life, while leaving more flexible sources (like a 401(k) or Roth IRA) for discretionary spending or emergency funds.

- Supplementing Social Security: For those who rely on Social Security but want additional security, annuities can complement Social Security payments, providing more reliable income and reducing the need to draw down savings.

5. Flexibility to Tailor to Individual Needs

Annuities offer customization options to fit individual needs and retirement timelines. This flexibility can be helpful for those who need extra support in later retirement years:

- Deferred Income Annuities (DIAs): Designed for retirees wanting income later, DIAs start payments at a specified age. They’re ideal for those who are still working or who have other income sources early in retirement but want a stable income as they get older.

- Longevity Annuities: Also known as Qualified Longevity Annuity Contracts (QLACs), these help protect against longevity risk by deferring income until a later age (like 80 or 85). They’re particularly useful for those concerned about their money lasting throughout the later years of retirement.

6. Insurance Company Backing and Security

Annuities are provided by insurance companies, which are legally required to hold significant reserves to meet their payout obligations. This means annuities are backed by the insurance company’s financial strength, and regulation helps ensure that you receive your payments as promised.

- Financial Stability: Reputable insurance companies are carefully regulated, and their financial strength is monitored, giving annuity holders peace of mind that payments are reliable.

- State Guarantee Associations: Most states have guarantee associations to protect annuity holders if the insurance company defaults, although the coverage varies by state.

7. Protecting Against Inflation with Cost-of-Living Adjustments

Some annuities offer options for adjusting your income payments to account for inflation, protecting your purchasing power over time. These adjustments are particularly beneficial for those concerned about rising costs eroding their income’s value.

- Cost-of-Living Adjustment (COLA) Riders: This feature increases payments based on inflation rates, helping you keep up with the cost of living.

- Purchasing Power Protection: By keeping your income aligned with inflation, COLA riders help ensure you maintain a similar standard of living, even as expenses increase in later years.

Conclusion

Annuities provide a reliable way to secure income for life, helping protect against the risk of outliving your savings. By understanding how annuities work — from lifetime income options to income riders, deferred income strategies, and inflation protection — you can decide if an annuity aligns with your retirement goals. In a world where lifespans are increasing, annuities offer a dependable solution for managing longevity risk, offering you peace of mind and a steady financial foundation for the future.

Recent Topic

Get Your Personalized Quote Today

Secure your future with a custom annuity plan. Quick, easy, and tailored to your needs—get your quote now!

"AnnuityFactCheck was a game-changer for me! I was overwhelmed by the different annuity options available, but their comprehensive guides and personalized support made the decision-making process so much easier. I now feel confident about my retirement plan and grateful for their expert advice!"

"I can't thank AnnuityFactCheck enough for their invaluable resources. Their articles helped me understand the ins and outs of annuities, and their team provided excellent guidance tailored to my needs. I finally found the right annuity that fits my financial goals!"

"AnnuityFactCheck was a game-changer for me! I was overwhelmed by the different annuity options available, but their comprehensive guides and personalized support made the decision-making process so much easier. I now feel confident about my retirement plan and grateful for their expert advice!"

"I can't thank AnnuityFactCheck enough for their invaluable resources. Their articles helped me understand the ins and outs of annuities, and their team provided excellent guidance tailored to my needs. I finally found the right annuity that fits my financial goals!"